Is This Self-Dealing? 3 Quick Questions to Ask

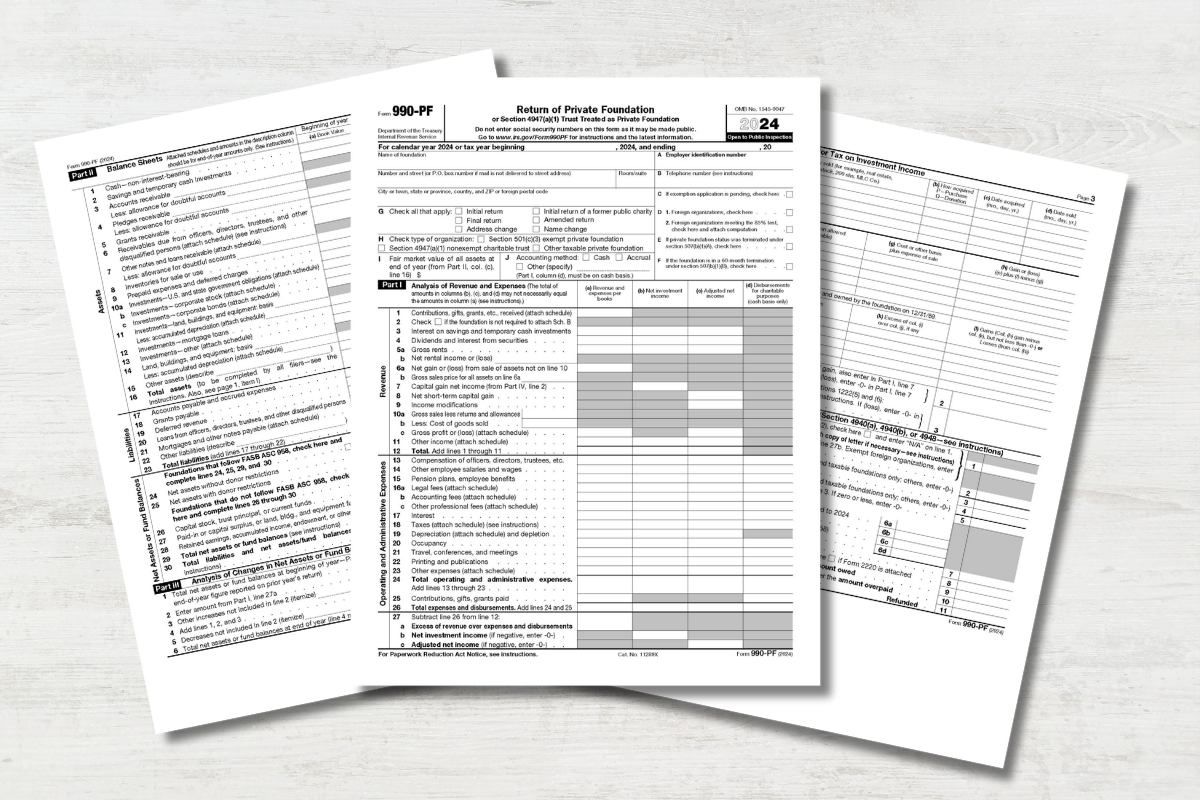

No topic within private foundation rules raises as many questions and concerns as self-dealing. The self-dealing rules prohibit a range of transactions between private foundations and their insiders (called disqualified persons) to ensure that foundation assets are used for charitable purposes rather than private benefit. Common Acts of Self-Dealing The self-dealing rules are broad and... Read More