Investment fees intertwine with market ups and downs, and both are integral to a foundation’s investment strategy. In low-return environments, higher fees could be a hindrance to higher return, but they might be necessary to reach to that higher return. It is more important than ever to be aware of the fees and costs so you can maximize your foundation’s mission.

Why Do Investment Fees Matter?

- Fees and costs diminish net returns.

- In a low-return environment, this impact is more evident than ever.

- Investment fees can fluctuate with the market.

- Investment fees and costs are inevitable, but where can we minimize them?

- Learn how you can you look towards more complete transparency on the fees and costs incurred on your portfolio.

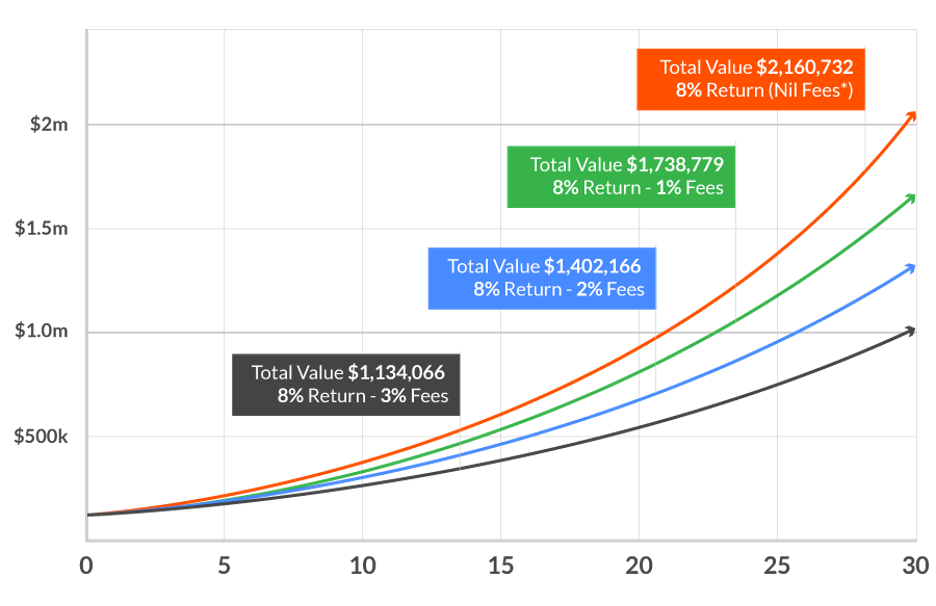

Fees Add Up Over Time

Terms To Know

- Expense ratio: The expense ratio is the annual fee that all funds or ETFs charge their shareholders. It expresses the percentage of assets deducted each fiscal year for fund expenses, management fees, administrative fees, operating costs, and all other asset-based costs incurred by the fund.

- Rate of return: A rate of return is the gain or loss on an investment over a specified period, expressed as a percentage of the investment’s cost. Gains on investments are defined as income received plus any capital gains realized on the sale of the investment.

- Explicit fees: Upfront product and management fees charges as a percent of AUM or per transaction. These expenses are spelled out in the documents and reported to investors.

- Intermediary fees & costs: Fees paid to financial intermediaries and service providers for product selection, management, and servicing. May include expenses arising from distributions. This includes wrap fees paid to brokers and fees paid to fund-of-funds and any other intermediaries.

- Implicit costs: Costs arising from underlying activity within the portfolio (trading). Examples include trading fees and tax consequences. When investors absorb these costs, they reduce net profits.

- Hidden fees & costs: Undisclosed expenses charged for maintenance of products. May include fund expenses, redemption fees, and underlying product fees.

How To Control Investment Fees

You should start by understanding the investment objective. For example, a more conservative strategy will likely incur lower fees at the expense of lower expected returns.

Assess fee for each investment in relation to:

- Expected return and risk for investment strategy

- Manager value added net of fees

- Diversification benefits

- Investment structure

- Your specific liquidity and financial circumstances

What Can Investors Do?

1) Ask questions. Then ask some more:

Your advisor should be able to address your questions and concerns and educate you on investment products you are unfamiliar with.

2) Do your research:

- Read the fine print—ADV, prospectus, Client Agreement, etc.

- Consult with peers and industry professionals.

3) Codify your unique needs and circumstances into an IPS and spending policy:

The needs of your foundation are unique, and the portfolio management must reflect that. Your investments and costs should be aligned with your needs and clearly outlined in an investment policy statement (IPS).

About the Author

Peter J. Klein, CFA®, CRPS®, CAP®, CSRIC® is the chief investment officer and founder of ALINE Wealth. Peter draws upon more than three decades’ worth of experience to provide guidance rooted in the science of investing to ALINE’s clients. Peter helps clients navigate family trusts, institutions, and nonprofits, aiding in the establishment of their legacies. For more information, please visit www.ALINEWealth.com.

ALINE Wealth is a group of investment professionals registered with Hightower Securities, LLC, member FINRA and SIPC, and with Hightower Advisors, LLC, a registered investment advisor with the SEC. Securities are offered through Hightower Securities, LLC; advisory services are offered through Hightower Advisors, LLC.