In 2022, the United States experienced historically high inflation rates. This took a toll on communities, nonprofits, and foundations alike. Inflation significantly impacted funders and altered the ways they approached grantmaking, grantees, and staff compensation. Some foundations even considered modifying their investment strategies to keep pace with rampant inflation. We compiled this information in our 2023 Foundation Operations and Management Survey and published the findings in the 2024 Foundation Operations and Management Report.

Supporting Rising Costs for Grantees

More than one-quarter of participating foundations (29%) helped grantees address increased costs associated with inflation. Interestingly, we found foundations that rated racial equity as somewhat or very relevant to their missions were most likely to do so.

Funders engaged in equity work appeared to be more responsive to their grantees’ needs.

Some of the ways foundations helped grantees with rising costs included:

- Converting programmatic grants to general operating support grants

- Increasing the size of grants

- Making additional grants

For more on how funders can help grantees with inflation, see the Exponent Philanthropy blog post “Lean Funders Can Help Nonprofits Tackle Inflation Costs.”

Compensating Foundation Staff

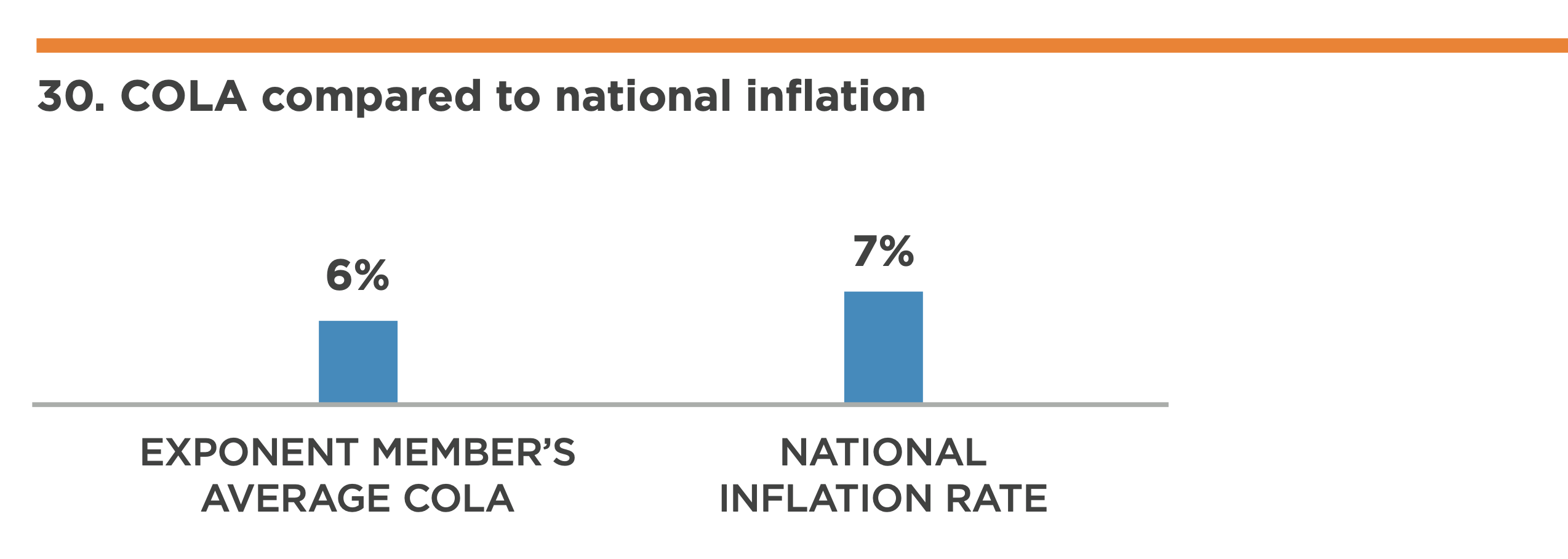

More than half (54%) of participating foundations said they made a cost-of-living adjustment (COLA) to employee salaries in response to inflation in 2022. On average, foundations gave employees a 6% increase (median of 5%).

When we explored the data more deeply, we found staff saw their salaries increase from 2021 to 2022 across the board. Salary data trended upward for CEO/top administrator, professional/grantmaking, and administrative/support staff salaries. However, these differences were not statistically significant for professional/grantmaking and administrative/support staff. CEOs got the most significant raises with the average CEO salary increasing 6.5% in 2022.

Modifying Investment Tactics

Only a small percentage (12%) of participating foundations adjusted their investment strategy in 2022. The vast majority (88%) stuck with their long-term investment strategy.

Of those that adjusted their portfolio allocations, most participating foundations (70%) increased their fixed-income investments, slightly less than half (39%) increased their alternative strategies, and a smaller proportion increased their domestic and international equity investments.

The foundation’s likelihood of adjusting its portfolio allocation in response to inflation did not vary significantly by key foundation characteristics.

Get your copy of the 2024 Foundation Operations and Management Report now »

About the Author

Brendan McCormick is the associate director of research and publications at Exponent Philanthropy. He works with members, partners, and staff to develop resources and research on our funder community.