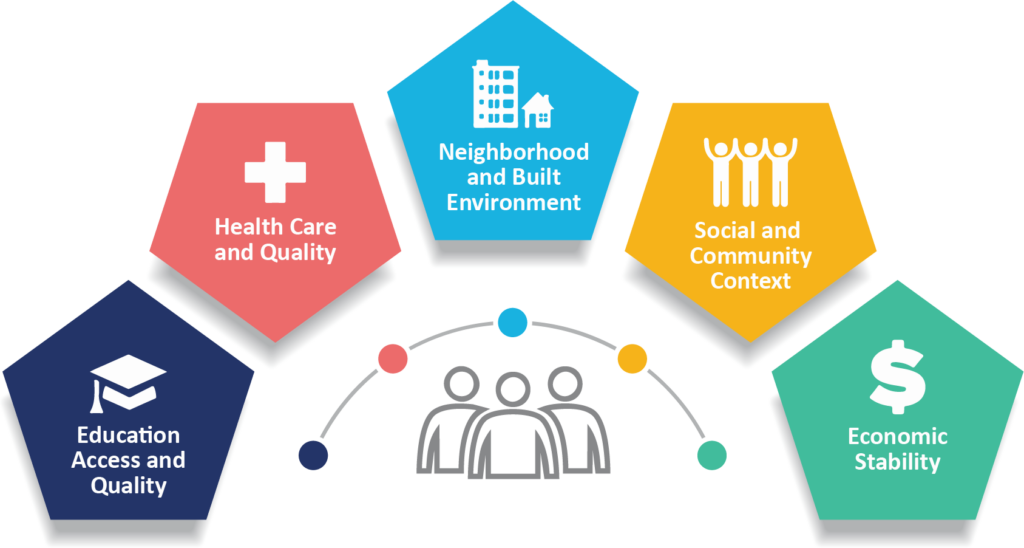

Social justice refers to everyone in society having equal access to the social determinants of health including economic stability; education access and quality; health care access and quality; neighborhood and built environment; and social and community content. For investors, a widening income inequality gap can change risk and return expectations across investment opportunities and may negatively impact long-term investment performance.

According to the Principles of Responsible Investment (PRI), income inequality issues can potentially:

- Negatively impact institutional investors’ portfolios.

- Increase financial and social system-level instability.

- Damage output.

- Reduce economic growth.

- Contribute to the rise of populism, extremism, isolationism, and protectionism.

Addressing Social Inequality

That said, OECD research found that a narrowing social inequality gap can boost economic growth. Increasing access to the social determinants of health can enhance upward social mobility and upskilling, and help people get out of poverty. What’s more, addressing social inequality will not only improve the quality of individual lives, but also society and the economy, ultimately raising productivity and boosting economic growth.

Given that this issue is systemic, there is no one way to approach it. Some people see social justice investing through the lens of business practices and workplace policies across asset classes. Others view social justice investing as products or services that drive an improved social outcome. Social justice investing also intersects with environmental issues and climate investing because those most impacted by climate change are those with the fewest resources.

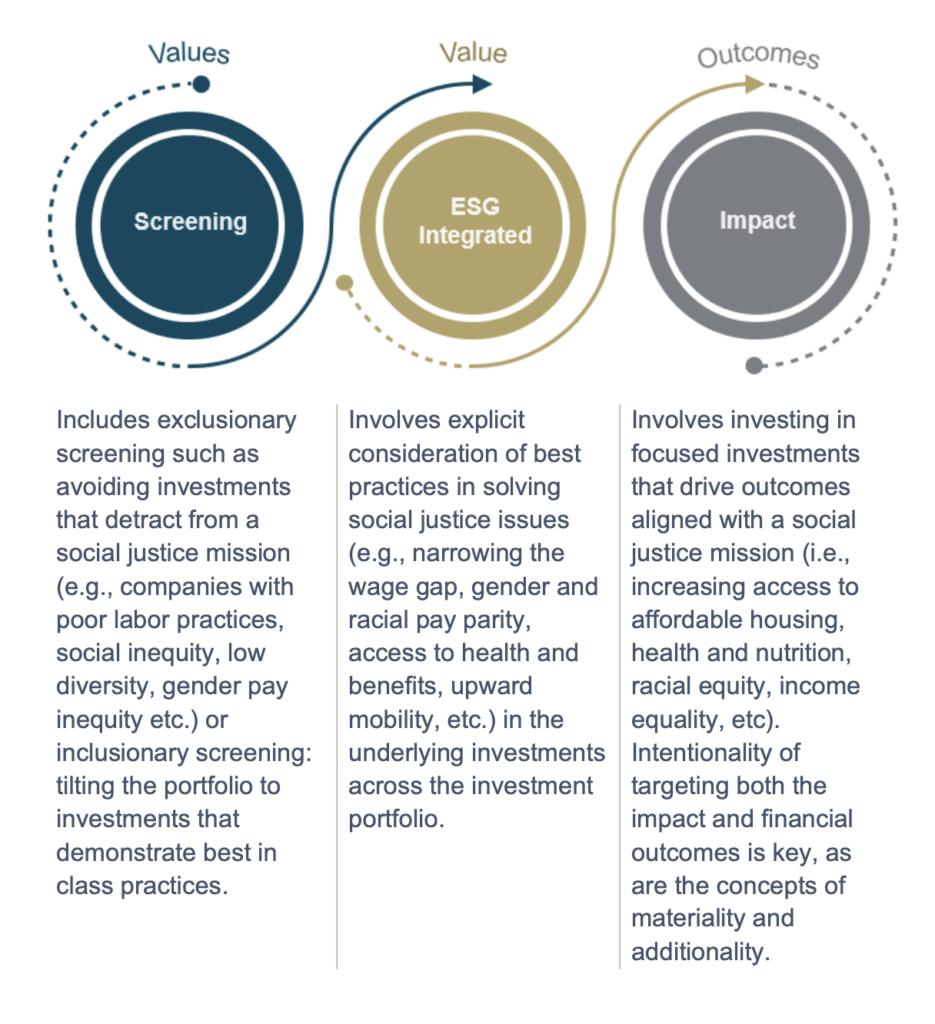

When evaluating managers or investment strategies, social justice investing can gauge your investment program alignment within the following bands:

- At minimum, does not exacerbate inequities across any of the social determinants; and

- At best, supports or drives outcomes that create a more equitable society.

Why Social Justice Investing?

Here are some ways a social justice aligned portfolio can drive positive change:

- A social justice-aligned portfolio can create leverage in activating the 95% investment corpus of a foundation’s portfolio to work towards enhancing a social justice mission.

- Program related investments (PRI) can create a multiplier effect of each dollar put to work, potentially resulting in a higher ROI, than if you paid out that dollar as a one-time grant.

- Impact investments can provide long-term patient capital for high-impact social ventures that are attempting to solve the most pressing social inequity challenges.

- Shareholder engagement can give the foundation a voice to share its views with other like-minded investors. Multi-stakeholder engagement can drive positive corporate behavior, which can move the needle towards narrowing social inequality gaps.

- Measuring outcomes is an ongoing challenge. The more asset owners ask for social justice investing, the more it incentivizes investee organizations to create it.

- If like-minded investors come together, they might be able to influence policy. For example, we saw minimum wages rising across various jurisdictions in the United States in recent years.

In these particularly challenging times exacerbated by a prolonged pandemic, geopolitical crises, and economic worries, it is even more critical to actively address social inequality across all dimensions of society.

Social Justice Investing Tools

Funders can deploy several social justice investing tools to implement a mission-aligned portfolio. Key inputs to determine which tools are most effective for the foundation’s investment program include an institution’s risk appetite (willingness and ability to take risk), liquidity needs, time horizon, spending needs, and resources available. Impact is a continuum, and the scale and depth will vary across the tools utilized.

As an example, the above framework applied with a diversity lens could look like this:

An active engagement approach involves active dialogue with investee companies, voting proxies or co-filing corporate resolutions on topics that support the institution’s mission. You can also implement these approaches in a place-based context, sometimes referred to community investing. For instance, public and private investment vehicles that invest in underserved communities would fall under the community investing umbrella.

Other institutions PRIs to utilize their grant dollars. This includes investing in sub-market (zero or low) interest rate loans or capital investments to further your charitable purpose. A PRIs primary objective is charitable, not financial return, and can be a part of the foundation’s annual spending requirements.

Investing in diverse-owned managers is another thing organizations should consider, across any of the above categories. This could include increasing access to and investments in investment strategies managed by majority diverse ownership (>50%) and/or substantial diverse ownership (20-50%). It may also include evaluating the diversity, equity, and inclusion (DEI) practices of all investment managers across the portfolio. Lastly, a portion of the portfolio could be allocated to investing in investment managers that prioritize investing in companies with strong DEI practices.

Where Do You Go from Here?

There is no one way to implement social justice investing and starting can be as simple as collecting information and asking your investment managers questions. You can use an incremental approach to enhance your portfolio alignment with a social justice mission, and clearly define goals as part of your investment policy statement.

About the Author

Manisha K. Ali, CAIA, CAP is the head of responsible investing at BNY Mellon Investor Solutions.

Disclosures

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation.

The Bank of New York Mellon, DIFC Branch (the “Authorised Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE.

The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA.

In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818.

Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd.

This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA.

This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such.

BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland.

Trademarks and logos belong to their respective owners.

BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

©2023 The Bank of New York Mellon Corporation. All rights reserved. | WM-412074-2023-08-03

Thank you for these thoughts. They encourage me to stay actively involved.